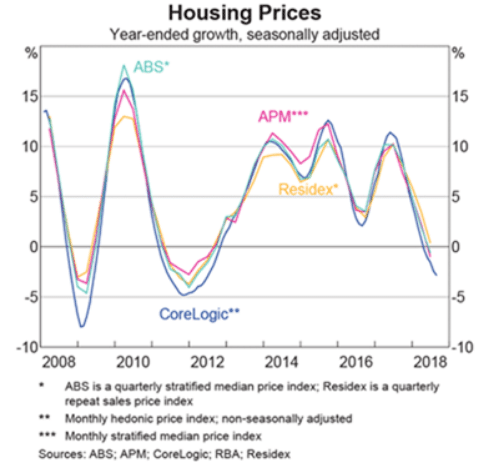

Residential house prices in Australia have risen over the past 5 years, with a number of catalysts responsible for the boom.

Residential house prices in Australia have risen over the past 5 years, with a number of catalysts responsible for the boom. Low interest rates, fear-of –missing-out (FOMO) along with a changing demand/supply relationship as demand was bolstered by the addition of overseas investors.

In recent times, we have seen a softening of house prices due to a number of factors:

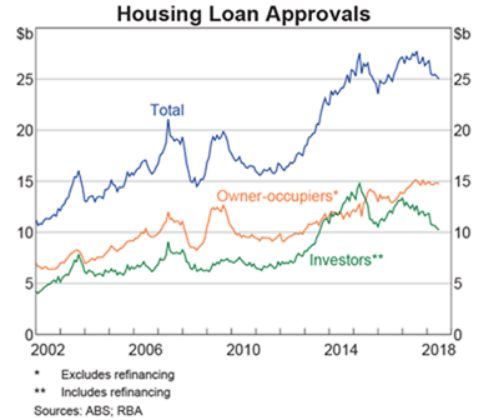

- offshore investor demand that helped boost prices has now dissipated,

- tighter lending restrictions imposed on investment buyers in the Australian market – in particular interest-only loans,

- FOMO no longer a factor,

- variable mortgage rates increasing due to funding issues confronting the banks despite the RBA cash rate remaining at 1.50%.

In addition, the prospect of changes to negative gearing and Capital Gains Tax relating to investment properties should a change in Federal Government occur may be keeping some investors on the sidelines.

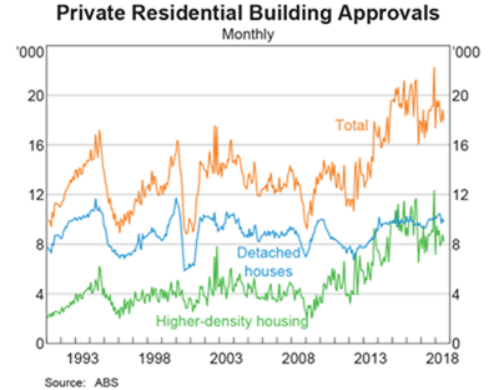

Demand/Supply imbalance

There has been a change of demand/supply fundamentals in the residential housing market .However, over-supply when looking at the overall market doesn’t appear to be part of the equation. That doesn’t mean that some parts of the residential housing market aren’t more vulnerable than others.

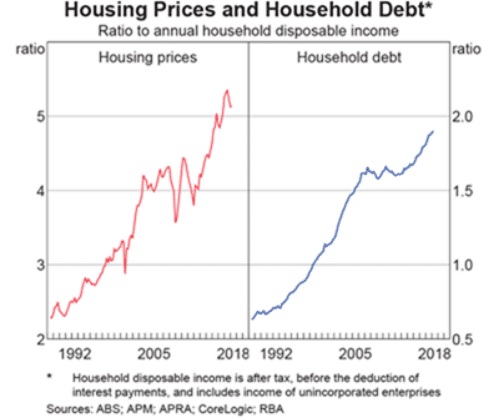

Valuation/Affordability

The above chart, shows the long term change in housing affordability as measured by the ratio of annual household disposable income to house prices (in red). Also, to put this in context we can see the growing ratio of household debt to disposable income. Importantly, this has occurred against a backdrop of falling interest rates in Australia (and globally).

Looking forward, given the rapid increase in house prices over the last 10 years the market should remain structurally sound from a lender’s (bank) perspective with the majority of home owners having seen the growth in their equity move upwards along with house prices. This mitigates the scenario whereby home owners have negative equity in their houses and are forced sellers. Basically, the pre-conditions for a collapse in housing prices don’t appear to exist.

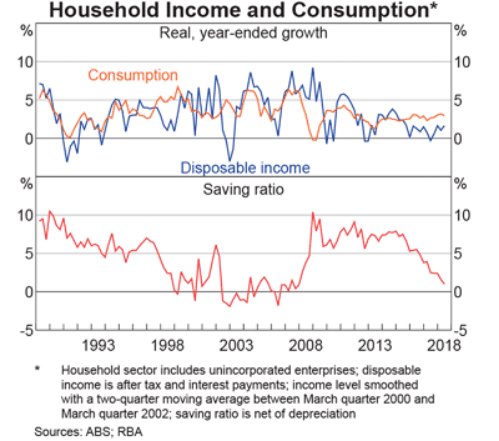

It should be noted that the housing sector could weaken further in part due to consumption growing faster than disposable income. This has seen a reversal in the household savings ratio which is approaching 0%. Falling house prices and prevailing uncertainty surrounding changes to negative gearing for investors may keep investors on the sidelines for a little while longer. As a consequence, there is no near term catalyst to see house prices begin to rise.

If you want to know more about Australian residential housing, you may contact me at bseeger@htawealth.com.au.